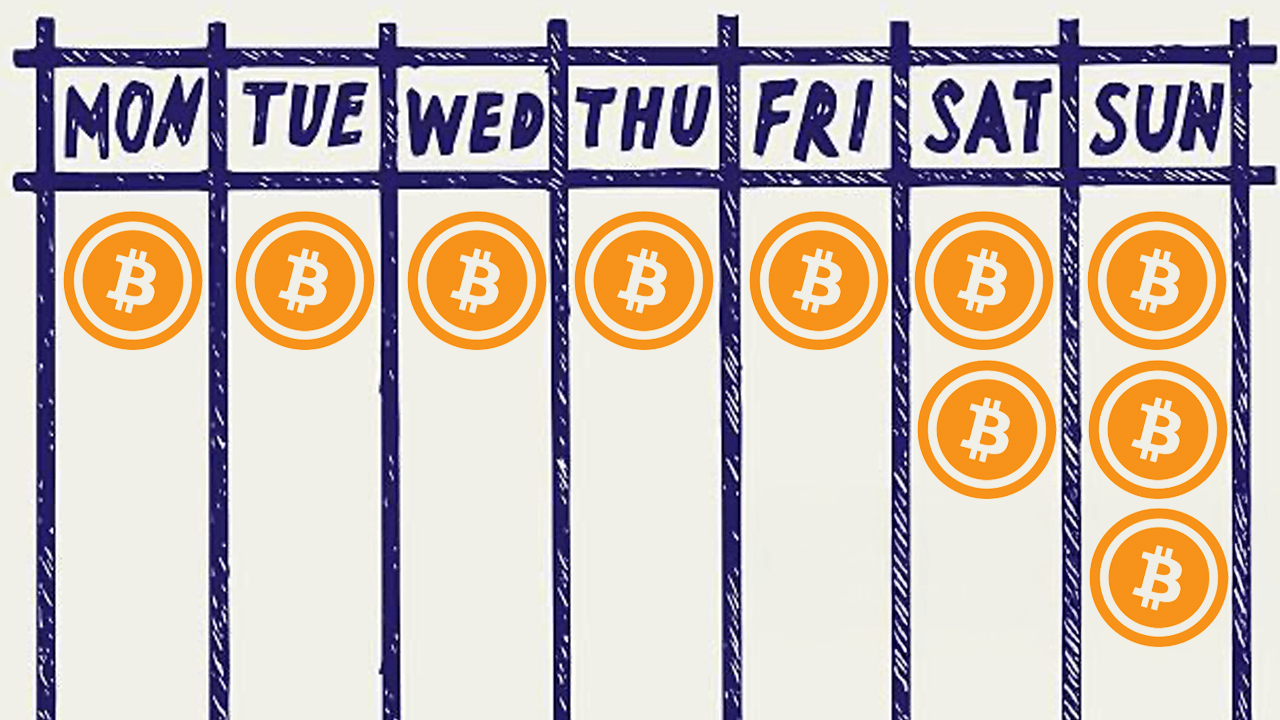

Understanding Bitcoin Trading Patterns: The Sunday Surge

In the ever-evolving world of cryptocurrency, Bitcoin continues to be a focal point for traders and investors. Recent observations have highlighted a significant trend: Bitcoin trading volumes experience a noticeable spike on Sundays. This surge is primarily attributed to the influence of institutional investors and their market hours. In this blog post, we will delve into the reasons behind this phenomenon and what it means for the future of Bitcoin trading.

The Rise of Institutional Investors

Over the past few years, institutional investors have increasingly entered the cryptocurrency market, bringing with them large sums of capital and a different trading strategy compared to retail investors. These investors typically operate during traditional market hours, which can lead to unique trading dynamics in the crypto market.

Key factors contributing to the rise of institutional investors include:

As institutional investors gain a foothold in the market, their trading habits significantly influence Bitcoin’s price movements and trading volumes.

Sunday Trading Behavior

The peculiar spike in Bitcoin trading on Sundays can be largely attributed to the timing of institutional trading activities. Most traditional financial markets are closed on weekends, but cryptocurrency markets remain operational 24/7. As a result, institutional investors often utilize Sundays to execute trades without the immediate influence of other market participants, particularly retail traders who may be less active during this time.

Several aspects of Sunday trading behavior include:

These factors contribute to the overall increase in Bitcoin trading volumes seen on Sundays.

The Impact of Market Hours

The influence of market hours cannot be overstated when analyzing Bitcoin trading patterns. Institutional investors generally operate within traditional market hours, which means they may refrain from trading during weekends. However, as the cryptocurrency market is always open, these investors often find Sundays to be a strategic time to engage in trading activities.

Significant implications of market hours include:

The recognition of these patterns can provide valuable insights for both institutional and retail traders alike.

What This Means for Retail Investors

For retail investors, the Sunday trading spike presents both opportunities and challenges. While it can be an advantageous time to trade, it is essential to approach this market behavior with caution and a clear strategy.

Considerations for retail investors include:

By staying informed and adapting to these market dynamics, retail investors can position themselves more favorably within the evolving landscape of Bitcoin trading.

The Future of Bitcoin Trading

As the cryptocurrency market matures, the influence of institutional investors is likely to continue shaping trading patterns. The Sunday trading spike is just one example of how traditional market behaviors can impact the crypto sphere.

Looking ahead, several trends may emerge:

Ultimately, understanding these trends will be vital for anyone looking to navigate the complex world of Bitcoin trading successfully.

Conclusion

The surge in Bitcoin trading on Sundays underscores the growing influence of institutional investors in the cryptocurrency market. By recognizing the patterns associated with their trading activities, both retail and institutional investors can better position themselves for success. As the market continues to evolve, staying informed and adaptable will be crucial for those looking to capitalize on the opportunities presented by this dynamic landscape.