Understanding the Surge: Bitcoin Trading on Sundays

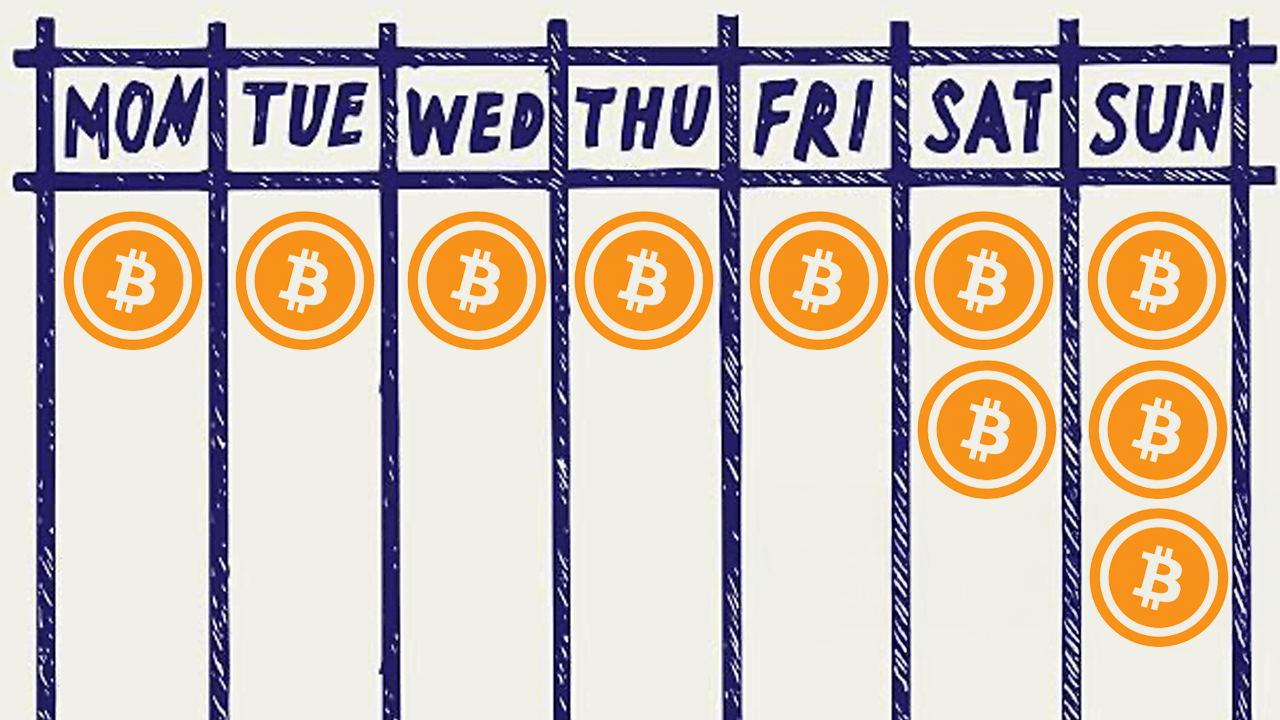

In the world of cryptocurrency, trends often emerge that can provide insights into market behavior and trading patterns. One such trend that has recently caught the attention of analysts is the noticeable spike in Bitcoin trading that occurs on Sundays. This phenomenon appears to be closely linked to the activities of institutional investors, who are increasingly playing a significant role in the cryptocurrency market.

The Rise of Institutional Investment in Bitcoin

Over the past few years, institutional investors have begun to take a keen interest in Bitcoin and other cryptocurrencies. This shift can be attributed to several factors:

As these institutions enter the market, their trading patterns are beginning to influence overall market dynamics, particularly on weekends.

Why Sundays See Increased Trading Activity

Sundays have emerged as a particularly active day for Bitcoin trading, and several factors contribute to this trend:

These factors combined create a unique environment where Bitcoin trading activity spikes significantly on Sundays, often leading to increased volatility.

Impact of Sunday Trading on Market Volatility

The surge in trading activity on Sundays can lead to notable changes in Bitcoin’s price. This increased volatility can be both an opportunity and a risk for traders. Here’s how Sunday trading impacts market behavior:

Understanding these dynamics is crucial for anyone looking to navigate the Bitcoin market, especially during these peak trading hours.

Strategies for Trading Bitcoin on Sundays

For both individual and institutional investors, developing a well-thought-out strategy for trading Bitcoin on Sundays can be beneficial. Here are some strategies to consider:

By implementing these strategies, traders can position themselves to take advantage of Sunday’s trading opportunities while minimizing potential risks.

Conclusion: The Future of Sunday Bitcoin Trading

As institutional involvement in the cryptocurrency market continues to grow, the trend of increased Bitcoin trading on Sundays is likely to persist. Understanding the reasons behind this surge and its implications for market volatility can empower traders to make more informed decisions.

As the market evolves, keeping an eye on institutional behaviors and adapting trading strategies accordingly will be essential. The interplay between traditional market hours and cryptocurrency trading activity creates a unique landscape that savvy investors can navigate for potential gains.

In summary, the connection between Sunday trading spikes and institutional market activity highlights the importance of understanding market dynamics in the cryptocurrency space. Whether you are an institutional investor or an individual trader, recognizing these patterns can be the key to successful trading in the ever-changing world of Bitcoin and beyond.