Understanding Bitcoin Trading Trends: The Sunday Surge

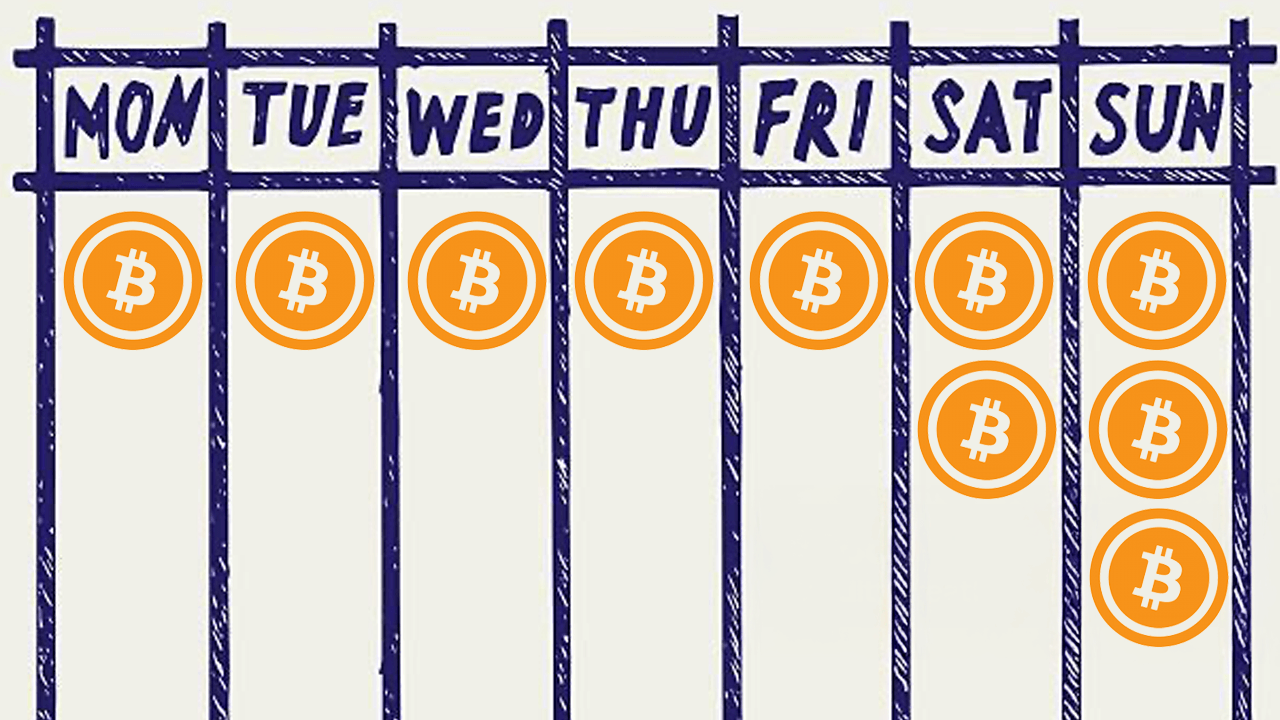

In the world of cryptocurrency, certain patterns and trends can often influence trading behavior. One intriguing observation is the notable spike in Bitcoin trading on Sundays. This phenomenon is increasingly being attributed to the operational hours of institutional markets, as institutional investors play a significant role in the dynamics of Bitcoin trading.

The Role of Institutional Investors

Institutional investors are large organizations that invest substantial amounts of capital in various assets, including cryptocurrencies. Their market activities significantly impact trading volumes and price movements.

Key reasons why institutional investors influence Sunday trading:

The Data Behind the Surge

Recent studies have shown a significant correlation between Sundays and increased Bitcoin trading volumes. Data analytics platforms have observed that Sundays often see higher trading activity compared to other days of the week, indicating that institutional strategies may be at play.

Statistics highlighting this trend include:

Market Sentiment and Its Impact

The sentiment surrounding Bitcoin can dramatically influence trading patterns. On Sundays, the mood can shift as investors reflect on the week’s developments and anticipate future movements.

Factors contributing to market sentiment on Sundays include:

Institutional Trading Strategies

Understanding the strategies employed by institutional investors can shed light on the reasons behind the Sunday trading surge. These strategies often involve a combination of fundamental and technical analysis, risk management, and market timing.

Common strategies include:

The Future of Bitcoin Trading on Sundays

As institutional involvement in the cryptocurrency market continues to grow, it is likely that the Sunday trading trend will persist. The implications of this trend could reshape how retail traders approach their strategies.

Potential future developments include:

Conclusion

The spike in Bitcoin trading on Sundays is a fascinating development influenced by institutional market dynamics. As institutional investors continue to engage with the cryptocurrency market, their impact will likely shape trading patterns and market sentiment in the future.

For traders—both institutional and retail—recognizing these trends can provide valuable insights into making informed trading decisions. Understanding the interplay between institutional trading strategies and market sentiment is essential for navigating the evolving landscape of Bitcoin trading.

As we move forward, the influence of institutional investors on Sundays will continue to be a key area of interest for market participants, making it a day to watch closely for potential trading opportunities.