Bitcoin Trading Surges on Sundays Due to Institutional Market Hours

In the ever-evolving landscape of cryptocurrency, Bitcoin has continuously proven to be a market leader. Recent trends indicate a significant surge in Bitcoin trading activity, particularly on Sundays. This phenomenon can be largely attributed to the operating hours of institutional investors. In this article, we will explore the reasons behind this surge, the behavior of institutional investors, and the implications for retail traders.

The Rise of Institutional Investment in Bitcoin

Over the past few years, institutional investors have increasingly entered the cryptocurrency market, bringing with them substantial capital and influence. With this influx of institutional money, the dynamics of trading have shifted, particularly around weekends.

Understanding Institutional Market Hours

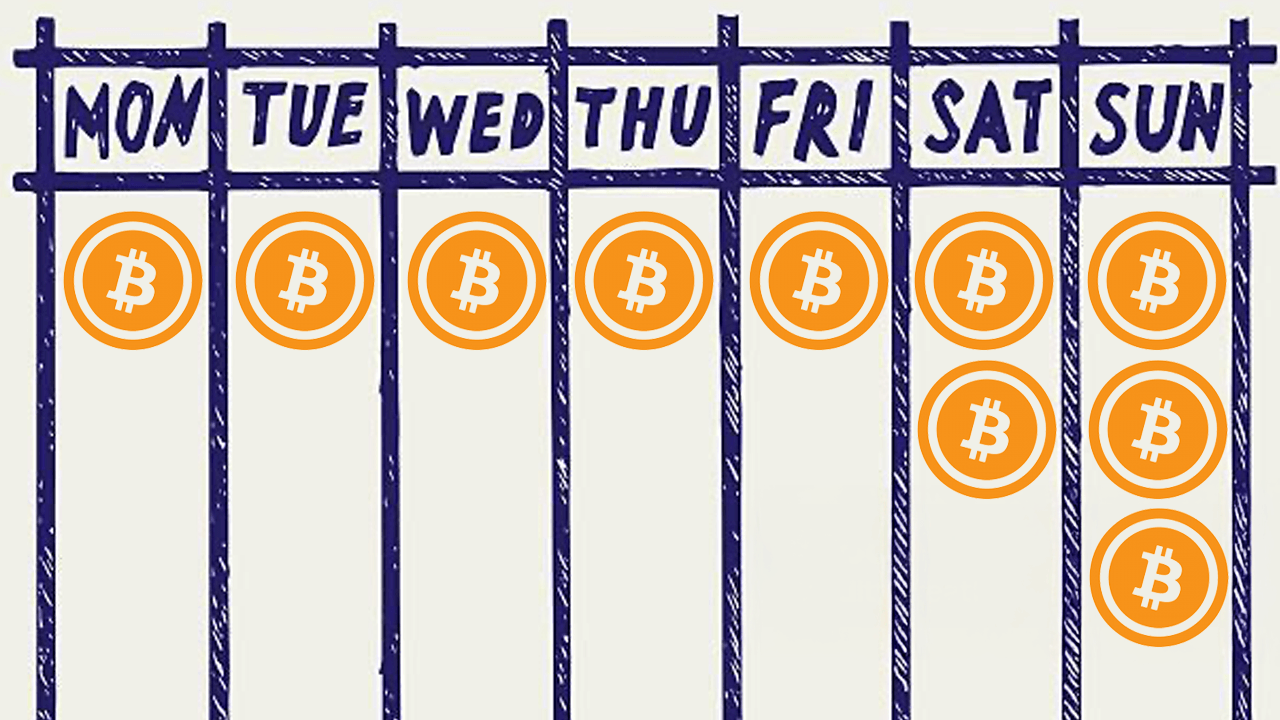

Unlike traditional stock markets that operate on weekdays, the cryptocurrency market is open 24/7. However, institutional investors typically adhere to conventional trading hours during the week. As a result, they often utilize Sundays to execute trades that may have been delayed or planned during the week. This has led to a noticeable increase in trading volume for Bitcoin on Sundays.

The Impact of Weekday Trading Patterns

The trading patterns observed during weekdays tend to differ from those on weekends. On weekdays, trading activity may be more restrained due to the high-volume transactions executed by institutions. Conversely, Sundays often see a buildup of pent-up demand, resulting in a spike in trading activity as institutions take advantage of the quieter market.

Reasons Behind the Sunday Trading Surge

Several factors contribute to the increased Bitcoin trading on Sundays:

The Role of Retail Traders

As institutional investors dominate the market, retail traders often find themselves at a crossroads. The heightened trading activity on Sundays presents both opportunities and challenges for individual investors.

Opportunities for Retail Traders

Retail traders can leverage the increased volatility and trading volume on Sundays to their advantage. Here are some strategies:

Challenges Faced by Retail Traders

While opportunities abound, retail traders also face challenges during the Sunday trading surge:

Future Implications for Bitcoin Trading

The growing trend of institutional investment in Bitcoin is likely to shape the future of cryptocurrency trading. As more institutions enter the market, the patterns of trading could evolve further, potentially leading to:

Conclusion

The surge in Bitcoin trading on Sundays, driven by institutional market hours, marks a significant trend in the cryptocurrency landscape. As institutional investment continues to grow, understanding these trading dynamics will be crucial for both retail and institutional traders alike. By recognizing the factors that lead to increased activity on Sundays, traders can better position themselves in this fast-paced market.

In conclusion, the evolution of Bitcoin trading patterns highlights the importance of adapting to market changes. Whether a seasoned institutional investor or a retail trader, staying informed and agile is key to navigating the complexities of the cryptocurrency market.