Bitcoin Price Stays at $85K Amid Fed Rate Cut Speculations

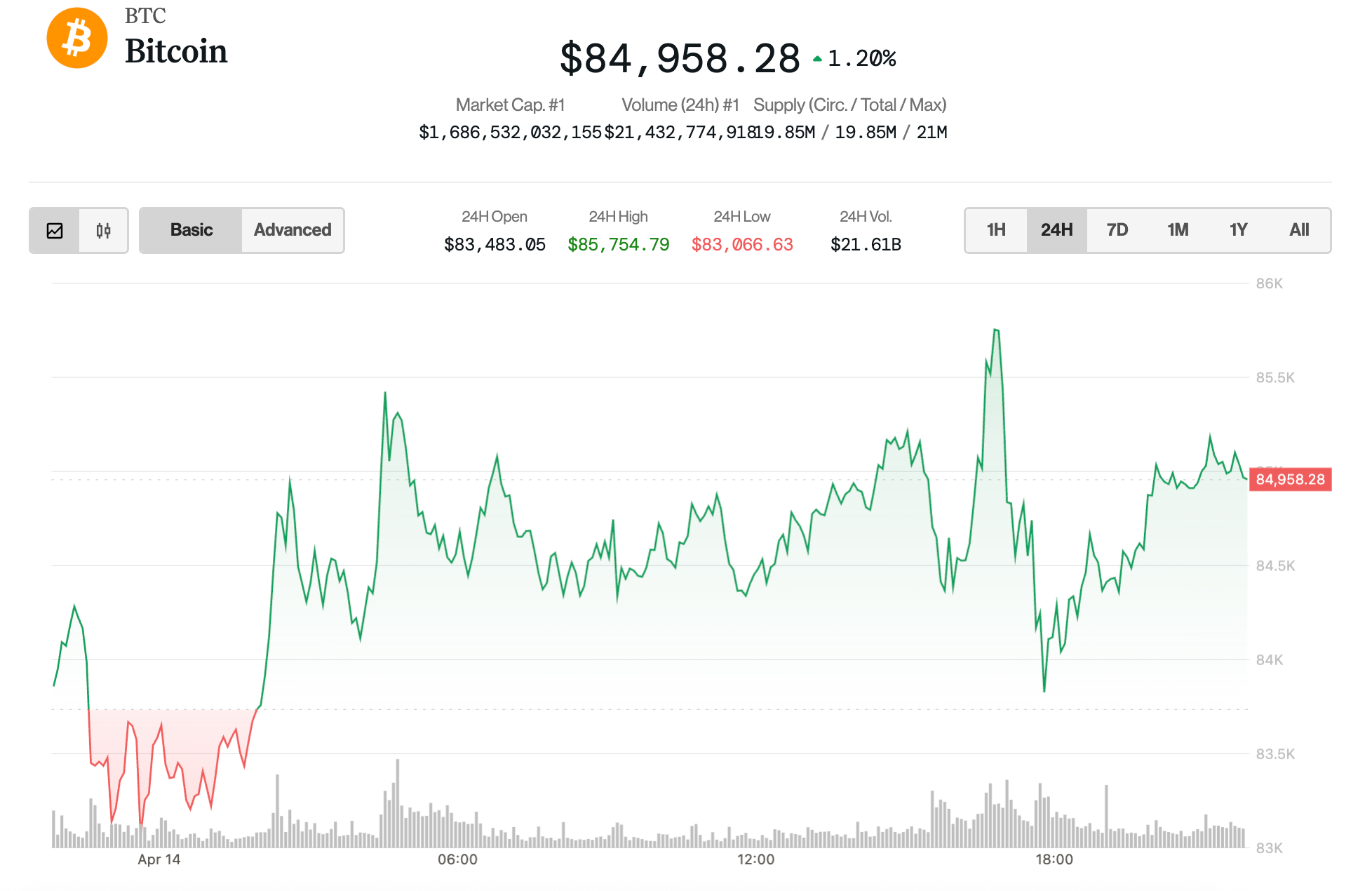

The cryptocurrency market has continued to capture the attention of investors and analysts alike, particularly with Bitcoin’s price maintaining a steady position at around $85,000. Recent statements from the Federal Reserve, particularly by Governor Christopher Waller, have fueled speculations regarding potential rate cuts, leading to a significant impact on Bitcoin and other digital assets.

The Current State of Bitcoin

As of now, Bitcoin is showing resilience despite fluctuations in global markets. Trading consistently around the $85,000 mark, many investors are pondering the implications of external economic factors on its price trajectory. The current price reflects a bullish sentiment among traders, especially in light of recent statements from financial authorities.

Understanding the Impact of Federal Reserve Signals

Governor Waller’s comments regarding the potential for rate cuts if tariffs are reinstated have stirred the waters of the financial landscape. Such statements can lead to various outcomes, particularly:

- Market Reactions: Investors often react to Federal Reserve signals, adjusting their portfolios accordingly, which can lead to short-term price volatility.

- Inflation Concerns: Rate cuts are typically seen as a response to economic slowdown and can increase concerns about inflation, driving more investors toward Bitcoin as a hedge.

- Increased Liquidity: Lower interest rates often lead to increased liquidity in the market, which can benefit risk assets like Bitcoin.

Why Bitcoin Is Viewed As a Hedge

Bitcoin has increasingly been regarded as a hedge against inflation and economic instability. As central banks around the world consider rate cuts to stimulate their economies, the appeal of Bitcoin grows, particularly for those looking to protect their wealth. Some key reasons for this perception include:

- Scarcity: Bitcoin’s supply is capped at 21 million coins, making it a deflationary asset.

- Decentralization: Unlike fiat currencies, Bitcoin operates independently of government control, making it less susceptible to monetary policy changes.

- Global Adoption: Increasing acceptance of Bitcoin among institutional investors and corporations enhances its legitimacy and perceived value.

The Broader Cryptocurrency Market Response

Bitcoin’s stability at $85,000 also reflects the sentiment in the broader cryptocurrency market. Other altcoins are experiencing varying levels of price movements, but Bitcoin often sets the tone. Here’s how the market is responding:

- Altcoin Performance: Many altcoins are following Bitcoin’s lead, with some showing significant gains as investor confidence returns.

- Institutional Investment: Increased interest from institutional investors is driving liquidity and boosting market sentiment.

- Regulatory Clarity: As regulations surrounding cryptocurrencies evolve, clearer frameworks may encourage more investments, further solidifying Bitcoin’s position.

Looking Ahead: Predictions for Bitcoin

While Bitcoin currently hovers around $85,000, market analysts are divided on future price predictions. Factors that could influence Bitcoin’s price in the coming months include:

- Federal Reserve Policies: Continued monitoring of the Fed’s stance on interest rates and tariffs will be crucial for predicting Bitcoin’s price trajectory.

- Global Economic Conditions: Economic indicators, such as inflation rates and unemployment figures, will impact investor sentiment.

- Technological Developments: Advances in blockchain technology and improvements in Bitcoin’s infrastructure may also affect its adoption and price.

Conclusion

As Bitcoin remains at the critical level of $85,000, the interplay between economic policies and cryptocurrency investments becomes ever more significant. With Federal Reserve speculations regarding rate cuts potentially affecting market dynamics, investors must stay informed and agile. The current landscape suggests that Bitcoin will continue to play a pivotal role in the financial ecosystem, attracting both seasoned investors and newcomers alike.

In a world where economic indicators are in constant flux, Bitcoin stands as a beacon for those seeking alternative investment opportunities. Its resilience amid uncertain times highlights the ongoing evolution of digital currencies and their place in the future of finance.