Introduction

The cryptocurrency market is known for its volatility, and recent events have showcased just how quickly sentiment can shift. Bitcoin, XRP, and ADA have all seen declines, largely influenced by Nvidia’s staggering $5.5 billion charge. This article delves into the implications of this financial setback for Nvidia and how it has affected the broader cryptocurrency market, particularly the prices of Bitcoin, XRP, and ADA.

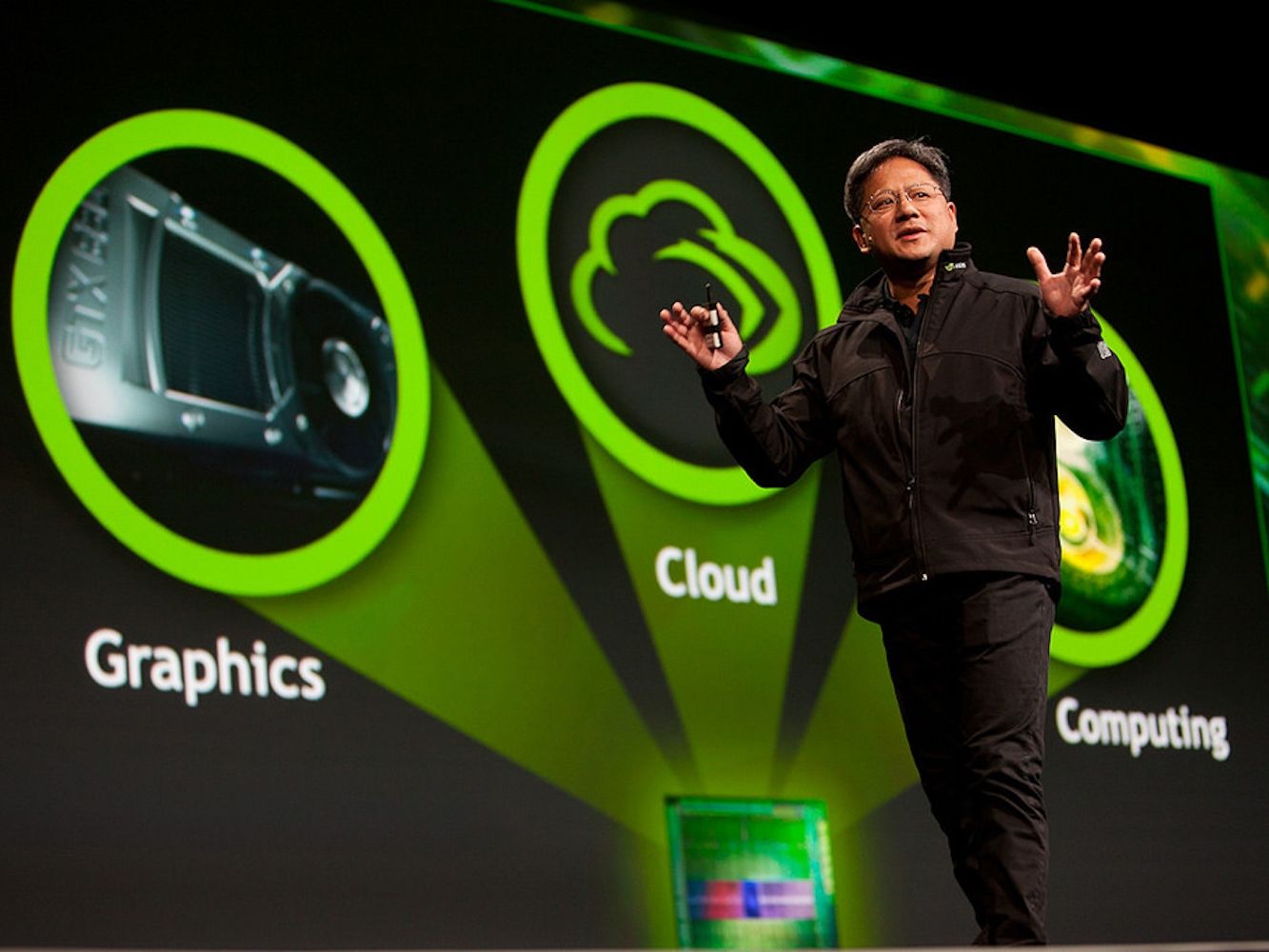

Nvidia’s Financial Disruption

Nvidia, a leading technology company primarily known for its graphics processing units (GPUs), recently announced a shocking charge of $5.5 billion. This revelation has sent ripples throughout the financial markets, raising concerns among investors.

What Led to Nvidia’s Charge?

Nvidia’s substantial charge can be attributed to several factors, including:

These issues have not only impacted Nvidia’s stock price but have also influenced investor sentiment across various sectors, including cryptocurrencies.

The Ripple Effect on Cryptocurrency

The decline of major cryptocurrencies such as Bitcoin, XRP, and ADA can be directly correlated with the negative sentiment stemming from Nvidia’s announcement. Investors in the crypto market are often highly sensitive to broader market trends and news, and Nvidia’s financial woes have raised concerns about the overall health of the tech sector and its implications for digital assets.

Bitcoin’s Struggles

Bitcoin, the largest cryptocurrency by market capitalization, has experienced a noticeable dip in value. Factors contributing to this decline include:

Market analysts have noted that this downturn could be a short-term reaction, but the overall sentiment is one of caution as investors await further developments.

XRP and ADA: Following the Trend

XRP and ADA are not immune to the effects of Nvidia’s financial situation. Both cryptocurrencies have seen a decline in price as well, which can be attributed to similar investor sentiments.

- XRP: As a popular cryptocurrency used for cross-border payments, XRP has faced increased scrutiny in recent months. The uncertainty surrounding its regulatory status has been compounded by Nvidia’s charge, leading to a drop in investor confidence.

- ADA: Cardano’s ADA has also felt the pressure, with investors wary of potential volatility in light of Nvidia’s news. The overall market sentiment has led many to reassess their investment strategies, resulting in a decline in ADA’s price.

The Broader Market Context

The cryptocurrency market does not exist in a vacuum. It is influenced by a multitude of external factors, including regulatory developments, technological advancements, and the performance of traditional financial markets.

Investor Sentiment and Market Dynamics

Investor sentiment plays a crucial role in the cryptocurrency space. When news such as Nvidia’s charge breaks, it can lead to a chain reaction:

This dynamic underscores the interconnectedness of the financial markets and the importance of keeping an eye on developments outside of the cryptocurrency realm.

Looking Ahead: What’s Next for Bitcoin, XRP, and ADA?

While the current landscape may seem bleak, it’s important to consider what the future may hold for Bitcoin, XRP, and ADA.

Potential Recovery Factors

Several factors could contribute to a potential recovery for these cryptocurrencies:

Conclusion

The decline of Bitcoin, XRP, and ADA amid Nvidia’s $5.5 billion charge serves as a reminder of the volatile nature of the cryptocurrency market. As investor sentiment shifts, it’s crucial for crypto enthusiasts and investors to remain informed and adaptable. While current trends may seem discouraging, the potential for recovery remains. The cryptocurrency landscape is ever-evolving, and with it comes the opportunity for growth and innovation, even in the face of adversity.

In summary, while the immediate outlook may appear challenging, the cryptocurrency market has shown resilience in the past. Keeping a close eye on technological advancements, regulatory developments, and overall market sentiment will be key for anyone looking to navigate the turbulent waters of cryptocurrency investment.