Understanding the Surge in Bitcoin ETF Demand

The world of cryptocurrency has seen a dramatic evolution in the past few years, especially with the rising interest in Bitcoin exchange-traded funds (ETFs). As institutional and retail investors continue to flock toward Bitcoin as a viable asset class, the demand for Bitcoin ETFs has surged significantly. This growing interest has created a unique scenario in which the demand for Bitcoin ETFs is far outpacing the current mining capacity, leading to various implications for the market.

The Role of Bitcoin ETFs

Bitcoin ETFs are investment funds that track the price of Bitcoin and are traded on traditional stock exchanges. They provide a way for investors to gain exposure to Bitcoin without the complexities of owning and managing the cryptocurrency directly. The key benefits of Bitcoin ETFs include:

- Accessibility: Investors can buy and sell Bitcoin ETFs like regular stocks, making it easier for those who are hesitant to navigate cryptocurrency exchanges.

- Regulatory Oversight: ETFs are subject to regulatory standards, providing a level of assurance for investors concerned about the lack of regulation in the cryptocurrency market.

- Diversification: Investors can include Bitcoin in their portfolios alongside other assets, potentially reducing overall risk.

The rapid growth in demand for Bitcoin ETFs reflects a broader acceptance of cryptocurrency as a legitimate investment option, especially among institutional investors who are looking to diversify their portfolios.

Mining Capacity Struggles to Keep Up

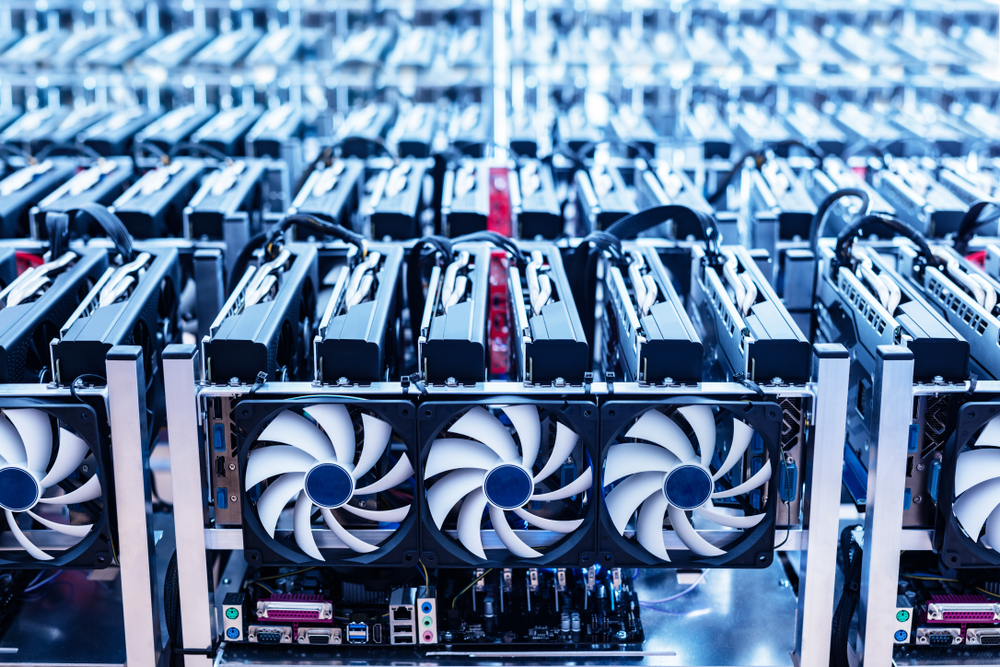

Despite the increasing interest in Bitcoin ETFs, the underlying infrastructure that supports Bitcoin – its mining capacity – is struggling to keep pace. Bitcoin mining is the process through which new bitcoins are created and transactions are verified on the blockchain. The challenge lies in the difficulty of mining, which is adjusted approximately every two weeks based on the total computational power of the network.

As the demand for Bitcoin rises, so does the need for more efficient mining operations. However, several factors are contributing to a bottleneck in mining capacity:

- Hardware Limitations: The mining industry is heavily reliant on sophisticated hardware. The demand for high-performance mining rigs has surged, leading to shortages and longer lead times for new equipment.

- Energy Constraints: Mining requires significant energy consumption, and many regions are facing energy shortages or are prioritizing energy for other uses, limiting the growth of mining operations.

- Regulatory Issues: In some areas, local regulations have restricted the establishment and operation of mining facilities, further hampering capacity growth.

These limitations in mining capacity create a paradox where the demand for Bitcoin ETFs continues to rise, but the actual supply of Bitcoin being produced does not meet this demand.

The Implications for Bitcoin Prices

The disparity between ETF demand and mining capacity can have several implications for Bitcoin prices. When demand outstrips supply, it often leads to price increases, which can attract even more investors to the market. This cycle can create volatility, as prices may surge rapidly in response to heightened interest.

Additionally, as Bitcoin prices increase, existing miners may become more incentivized to expand their operations, potentially leading to a surge in new mining facilities being established. However, this process takes time and may not happen immediately, meaning that the pressure on supply could persist.

The Future of Bitcoin ETFs and Mining

As we look to the future, the relationship between Bitcoin ETFs and mining capacity will be crucial in shaping the cryptocurrency landscape. Several trends may emerge:

- Increased Investment in Mining Technology: With the current supply constraints, there may be a surge in investment in more efficient mining technologies and renewable energy sources to meet the growing demand.

- Expansion of Mining Locations: Miners may seek out new regions with favorable regulatory environments and energy sources to expand their operations.

- New Financial Products: As the cryptocurrency market matures, we may see the introduction of more financial products that cater to different investor needs, including various types of crypto-based ETFs.

Overall, the future of Bitcoin ETFs and mining capacity will likely be intertwined. As institutional investment continues to grow, the mining industry will need to adapt to meet the demands of an evolving market.

Conclusion

The surge in demand for Bitcoin ETFs signifies a growing acceptance of cryptocurrency in mainstream finance. However, the struggle of mining capacity to keep up with this demand creates a complex dynamic that could impact Bitcoin prices and the overall market landscape.

Investors should remain aware of these developments as they navigate the cryptocurrency market. By understanding the underlying factors influencing Bitcoin’s supply and demand, investors can make more informed decisions and better position themselves for the future.

In a rapidly changing environment, staying updated on trends in both Bitcoin ETFs and mining capacity will be essential for anyone looking to engage with the cryptocurrency market effectively. The intersection of these two elements will shape not only the future of Bitcoin but also the broader landscape of cryptocurrency investment.