Understanding the House Vote on DeFi Broker Rule

In a significant political move, the House has passed a vote to nullify the controversial tax reporting requirements imposed on decentralized finance (DeFi) platforms. Critics have labeled these requirements as technically impossible to implement, raising serious concerns regarding the practicality and feasibility of such regulations. This article delves into the details surrounding this bipartisan coalition’s decision, the implications for the DeFi landscape, and the broader context of government regulation in the financial sector.

The Background of the DeFi Broker Rule

The Biden administration introduced the DeFi broker rule as part of a broader push to regulate the cryptocurrency industry. The intention was to bring transparency and accountability to the rapidly evolving DeFi space, which has been characterized by its lack of clear regulatory oversight. However, the rule faced immediate backlash from various stakeholders, including industry players, advocates for innovation, and even some lawmakers.

Key Concerns Raised by Critics

Critics of the rule have articulated several key concerns that ultimately led to the bipartisan coalition’s decision to overturn it:

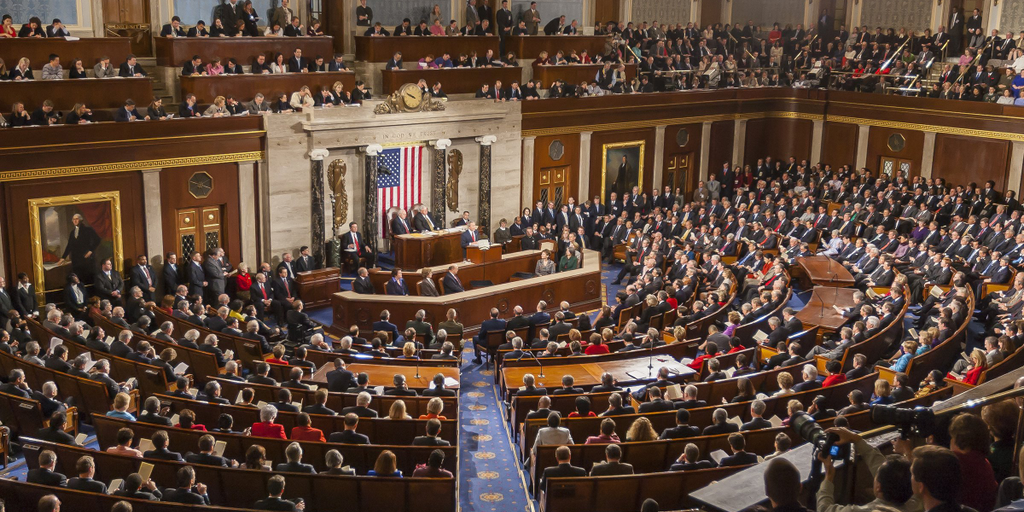

The Bipartisan Coalition’s Vote

The coalition that emerged to vote against the DeFi broker rule was notable for its bipartisan nature. Lawmakers from both sides of the aisle recognized the potential pitfalls of enforcing such regulations.

Reasons for Bipartisan Support

The bipartisan support can be attributed to several factors:

Implications for the DeFi Industry

The House’s decision to nullify the DeFi broker rule carries several implications for the industry as a whole.

Positive Outcomes for DeFi Platforms

The vote is likely to offer a sense of relief to DeFi platforms that were bracing for compliance with the onerous tax reporting requirements. Some of the potential positive outcomes include:

The Need for Future Regulations

While the nullification of the DeFi broker rule is a win for many, it highlights the need for a balanced regulatory approach moving forward.

The Future of DeFi Regulation

As the DeFi landscape continues to evolve, the question of regulation remains at the forefront. The recent bipartisan vote represents a significant step towards re-evaluating how decentralized finance should be approached by lawmakers.

What Lies Ahead?

The future of DeFi regulation will likely involve:

In conclusion, the recent vote by the House to overturn the Biden-era DeFi broker rule signifies a pivotal moment in the relationship between decentralized finance and government regulation. While this decision raises hopes for a more supportive environment for innovation, it also calls for a careful and thoughtful approach to future regulations. As the DeFi sector continues to grow, ongoing dialogue and collaboration will be essential in shaping a landscape that balances innovation with accountability.